maine tax rates compared to other states

For more information about the income tax in these states visit the Maine and Massachusetts income tax pages. In other words the registration rates of those counties exceeded 100 of eligible voters.

This means that income from capital gains can face a state rate of up to 715 in Maine.

. Income Tax Brackets for Other States. Showing 1 to 498 of 498 entries. Massachusetts taxpayers pay 105.

Compare State Tax Brackets Rates. The study found eight states showing state-wide. MEETRS File Upload Specifications.

Maine tax rates compared to other states. Up to 25 cash back 14. Monday June 13 2022.

Thats why we came up. The five states with the lowest. These rates apply to the tax bills that were mailed in August 2021 and due October 1 2021.

Maines State sales tax is 550. Texas residents also dont pay income tax but spend 18 of their income on real estate taxes one of the highest rates in the country. Other states that tax residents income might allow taxpayers to exclude a portion of their military retirement benefits from taxable income or offer other.

Welcome to Maine FastFile. Maine sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. The previous 882 rate was increased to three graduated rates of 965 103 and 109.

Tax Relief Credits and Programs. Therefore 55 is the highest possible rate you can pay in the entire state of Maine. Sales Taxes in Maine unlike many states Maine only has a states sales tax ie.

Other tobacco products tax declaration. The state ranked No. The base state sales tax rate in Maine is 55.

As many of you probably already know the mil rate is only one of the equations in determining how much youd pay in property taxes. Other things to know about Maine state taxes. This tool compares the tax brackets for single individuals in each state.

These income tax brackets and rates apply to Maine taxable income earned January 1 2020 through December 31 2020. Maine Tax Rates Compared To Other States. Its pretty fascinating to see the growth rate over the past several years.

Maine Tax Rates Compared To Other States. It also has above average property taxes. The Maine Single filing status tax brackets are shown in the table below.

Vehicle Property Tax Rank Effective Income Tax Rate. Maines tax system ranks 33rd overall on our 2022 State Business Tax. The five states with the lowest top marginal individual income tax rates are.

State Tax Rates Comparison Property Sales Income Social Security Tax. For income taxes in all fifty states see the income tax. One tax collection area where New Hampshire outpaces its neighbor.

No local sales tax. Use this tool to compare the state income taxes in Maine and Massachusetts or any other pair of states. As this years tax-filing deadline April 18 comes closer its.

In other words the tax is accessed only on C Corporations. The rates ranged from 0 to 795 for tax years beginning after December 31 2012 but before January 1 2016. In the overall rankings other New England.

Cigarette tobacco products instructional bulletin. Maine has a 550 percent state sales tax rate and does not levy any local sales taxes. While it does not tax Social Security income other forms of retirement income are taxed at rates as high as 715.

Instead it only uses the state tax rate of 55 percent. 21 in a comparison of individual income taxes and No. Based on this chart New Hampshire taxpayers pay 97 of their total income to state and local taxes.

Compare these to California where residents owe almost 5 of their income in sales and excise taxes and just 076 in real estate tax. But the above chart provides a rather crude measurement of comparative state and local tax burdens because everybody is lumped together regardless of income. This year Uncle Sam will take his cut of the past years earnings on May 17 slightly later than usual due to the COVID-19 pandemic.

20 for sales and excise taxes. In April 2021 New Yorks highest tax rate changed with the passage of the 20212022 budget. For your personal Effective IRS Tax Rate use the RATEucator Tool.

Maine has three marginal tax brackets. Maine does not combine state and local taxes to calculate its sales tax rate. Maine Tax Brackets for Tax Year 2020.

Property Taxes in Maine the average property tax rate for residential property in the state of Maine is 1. Individual Income Tax 1040ME Maine generally imposes an income tax on all individuals that have Maine-source income. Local tax rates in Maine range from 550 making the sales tax range in Maine 550.

All these rates apply to incomes over 2 million with the highest rate of 1090 applying to incomes over 25 million. Sales and Property Taxes in Maine. Maine has a graduated individual income tax with rates ranging from 580 percent to 715 percent.

The general sales tax is 55 and there are no local sales taxes meaning 55 is the highest sales tax rate youll encounter. Maine also has a corporate income tax that ranges from 350 percent to 893 percent. For income taxes in all fifty.

Find your Maine combined state and local tax rate. Franchise Tax Bd Cast Tax. The second variable is how much your property is assessed at.

Office of Tax Policy. Unable to retrieve data. The general sales tax rate is 550.

The income tax rates are graduated with rates ranging from 58 to 715 for tax years beginning after 2015. No state sales tax. Compared with other states Maine has relatively punitive tax rules for retirees.

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa. Maine levies taxes on tangible personal property which includes physical and digital products as well as some services. Residents of Maine are also subject to federal income tax rates and must generally file a federal income.

Compared to other states maine has relatively punitive tax rules for retirees. These rates apply to the tax bills that were mailed in August 2021 and due October 1 2021.

Maine Tax Rates Rankings Maine State Taxes Tax Foundation

State Income Tax Rates What They Are How They Work Nerdwallet Florida Florida Living Beach Trip

Cigarette Excise Taxes In Select States Per Pack Infographic Http On Wsj Com K81nby Infographic The Selection Tax

Maine Tax Rates Rankings Maine State Taxes Tax Foundation

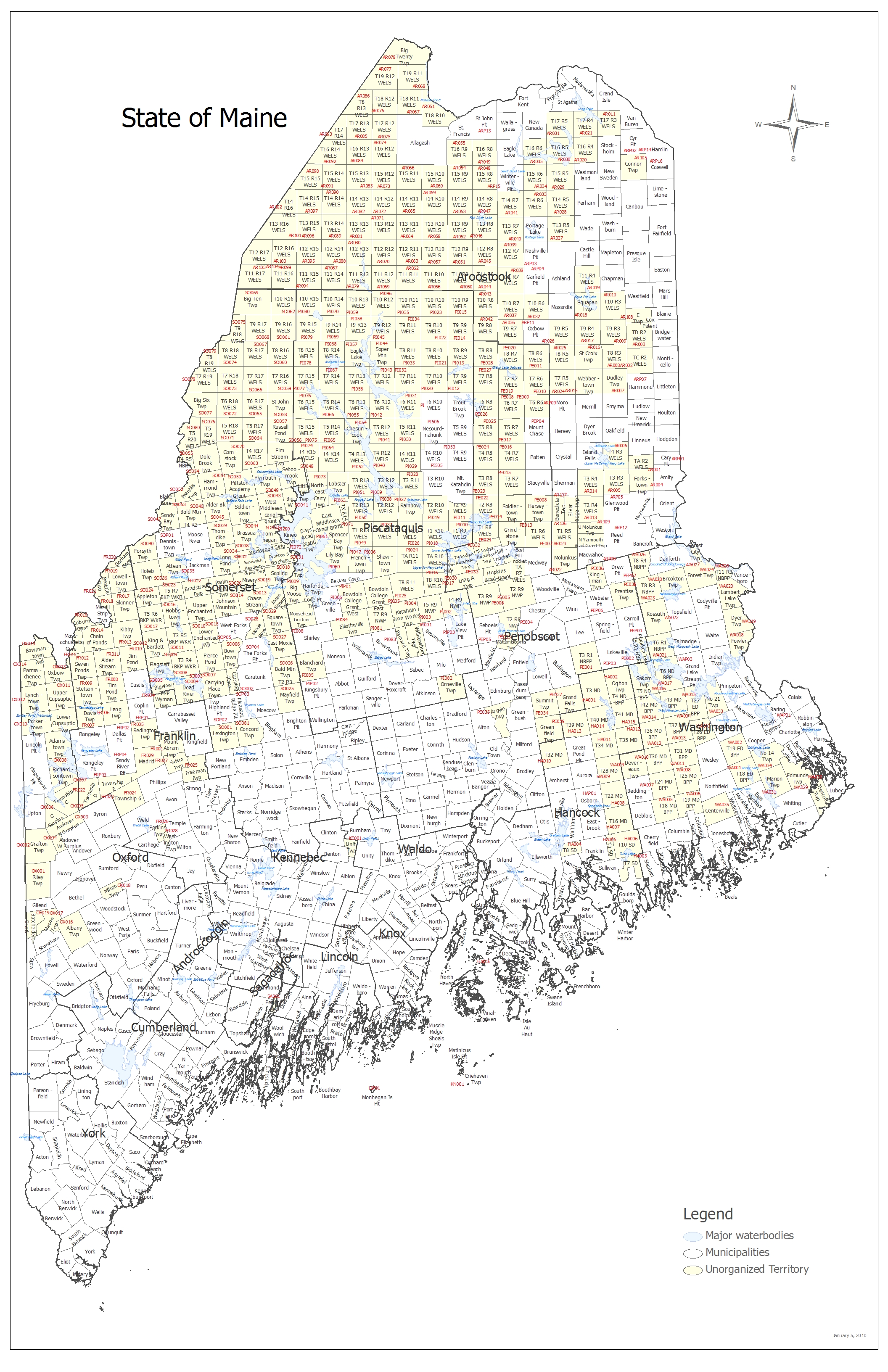

Tax Maps And Valuation Listings Maine Revenue Services

Median Household Income And Taxes State Tax Levels In The United States Wikipedia Ricevimenti Valutazione

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Chart 3 Oklahoma State And Local Tax Burden Vs Major Industry Fy 2015 Jpg Private Sector Industry Sectors Burden

Sales Tax On Grocery Items Taxjar

Chart 2 Colorado Tax Burden By Type Of Tax Fy 1950 To 2016 Jpg Types Of Taxes Income Tax Chart

States With Highest And Lowest Sales Tax Rates

Pin On 529 College Savings Plan Board 529 Plans

Chart Current Mortgage Closing Costs Listed By State Closing Costs Mortgage Interest Mortgage

A Carbon Tax Wave 7 States Considering Carbon Pricing To Fight Climate Change Climatechange Carbon Climate Change Policy Climate Change Climate Warming

Maine Tax Rates Rankings Maine State Taxes Tax Foundation

Maine Child Care Aware Of America